The Only Guide to $100 Loan Instant App

Table of ContentsHow Instant Cash Advance App can Save You Time, Stress, and Money.The Best Personal Loans StatementsOur Instant Cash Advance App StatementsLittle Known Facts About Loan Apps.Not known Details About Loan Apps 5 Easy Facts About $100 Loan Instant App Shown

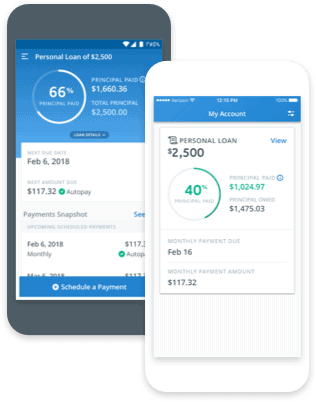

With an individual finance, you pay fixed-amount installations over a set duration of time up until the financial debt is entirely paid off. Prior to you look for an individual financing, you ought to understand some typical loan terms, consisting of: This is the quantity you obtain. If you apply for an individual funding of $10,000, that amount is the principal.

Unknown Facts About Instant Cash Advance App

APR represents "interest rate." When you take out any kind of kind of funding, in addition to the passion, the lender will typically charge fees for making the lending. APR integrates both your rates of interest and any type of loan provider costs to offer you a far better picture of the actual cost of your funding.

The number of months you need to pay off the finance is called the term. When a lending institution approves your personal finance application, they'll inform you of the passion price and term they're offering. Monthly during the term, you'll owe a monthly payment to the lender. This payment will include cash toward paying down the principal of the quantity you owe, in addition to a section of the overall rate of interest you'll owe over the life of the funding.

With a home or automobile lending, the genuine residential or commercial property you're purchasing serves as security to the loan provider. $100 loan instant app. An individual loan is normally just backed by the great credit history standing of the customer or cosigner. Some loan providers provide secured individual loans, which will call for collateral, as well as could provide far better prices than an unprotected finance.

The Instant Cash Advance App PDFs

In the short term, also lots of hard questions on your report can have a negative effect on your credit report rating. If you'll be window shopping by relating to more than one lending institution, be sure to do so quickly framework to reduce the effect of difficult inquiries.

On the bonus side, an individual lending can aid you make a big purchase. Damaging a big cost into smaller sized payments in time can aid make that cost extra manageable when you have steady revenue. Individual financings usually have passion rates that are lower than what you would certainly pay for a charge card purchase.

, and mix of credit score types. best personal loans.

The Best Strategy To Use For Best Personal Loans

When your organization is still young as well as expanding, it is likely that you won't have adequate capital to feed its development to ensure that it can realize its complete capacity. Such are the moments when you will intend to discover your alternatives in regards to finance. One of these choices is financial institution loaning.

Prior to you rush to the nearby financial institution, nonetheless, it is crucial that you recognize what the benefits as well as disadvantages of a small business loan are. Big purchases, particularly those of possessions essential to your company, will at some point be required at some time or other. A bank finance can aid in such circumstances.

Getting My Instant Loan To Work

Financial institutions supply a large benefit right here because, without them, it would certainly not be easy for lots of individuals to begin businesses or grow them. For some, it would be downright impossible. Normally, when you take a car loan from a bank, the bank does not inform you what you're going to make with that money.

These will certainly be various from one instant cash advance app financial institution to the next and are generally negotiable, enabling you to opt for the terms that favor you one of the most. With the capacity to search from one bank to one more and also to negotiate for better terms, it's really easy to get a sweet handle a small business loan.

If you take out a long term loan from a financial institution and make all of your payments promptly, your credit history will certainly improve over the life of the car loan. In instance you end up paying off the entire finance in a timely manner with no missed out on repayments, your credit report will actually boost.

Loan Apps for Beginners

Depending on exactly how the agreement is drawn up, you run the risk of the bank foreclosing on your service in the event that you are unable to settle the car loan. Most service financings are protected, which suggests something is backing the finance. Maybe collateral or an assurance. If the loan is protected by collateral, then the financial institution can claim some possession of your own or your organization in case you can not repay the lending.